Tackle late payments in a matter of minutes

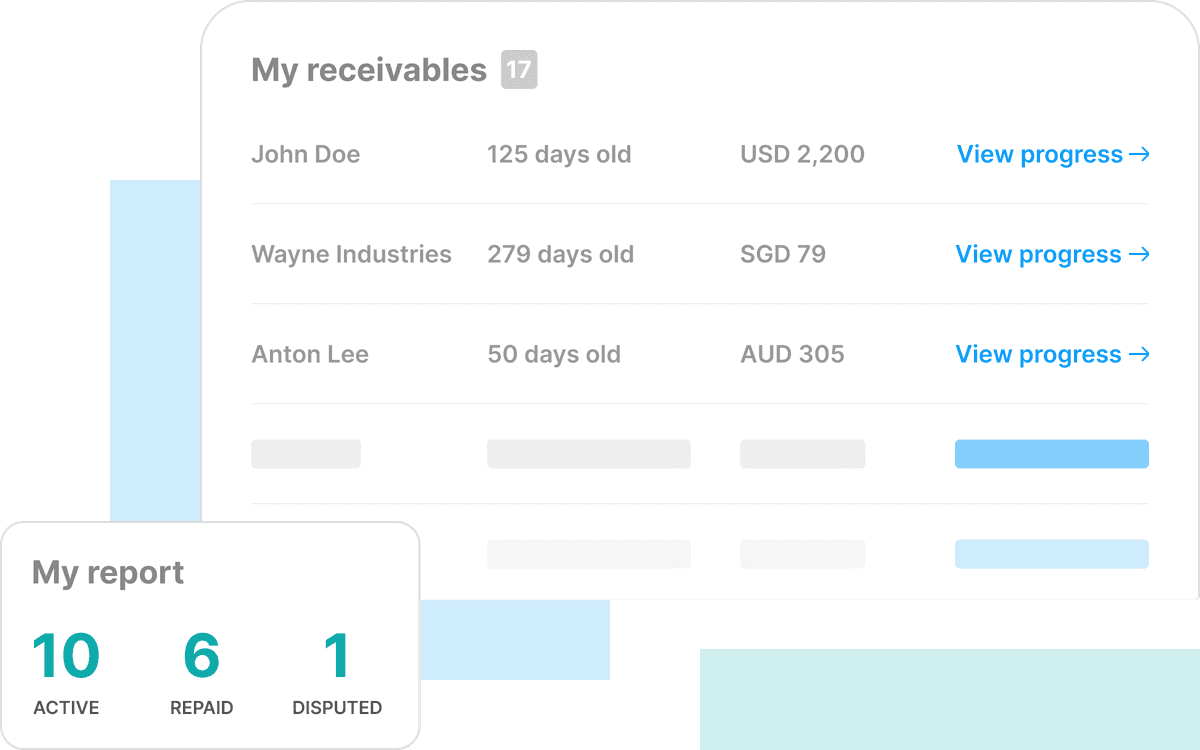

Effortlessly manage all your stubborn account receivables permanently on a single platform with no additional costs.

Don't lose sight of what's owed

531%

faster than lawyers

7.5x

cheaper than debt collectors

45

average repayment days

Tired of sending multiple chasers and getting no response?

Are you avoiding collection agencies to protect your reputation?

Simple way to manage claims even when they're written-off from the accounting books or have past the statue of limitations

Artists. Designers. Consultants. Accountants. Lawyers. Architects. Engineers. Valuers. Marketers.

We have collaborated with numerous collection agencies, yet it was Payre who successfully collected all 11 overdue invoices from my clients within 60 days, without risking my reputation.

Sharon Lee

Consultant at Digital Marketing Lab

Australia

Frequently asked questions

Is Payre a debt collection agency?

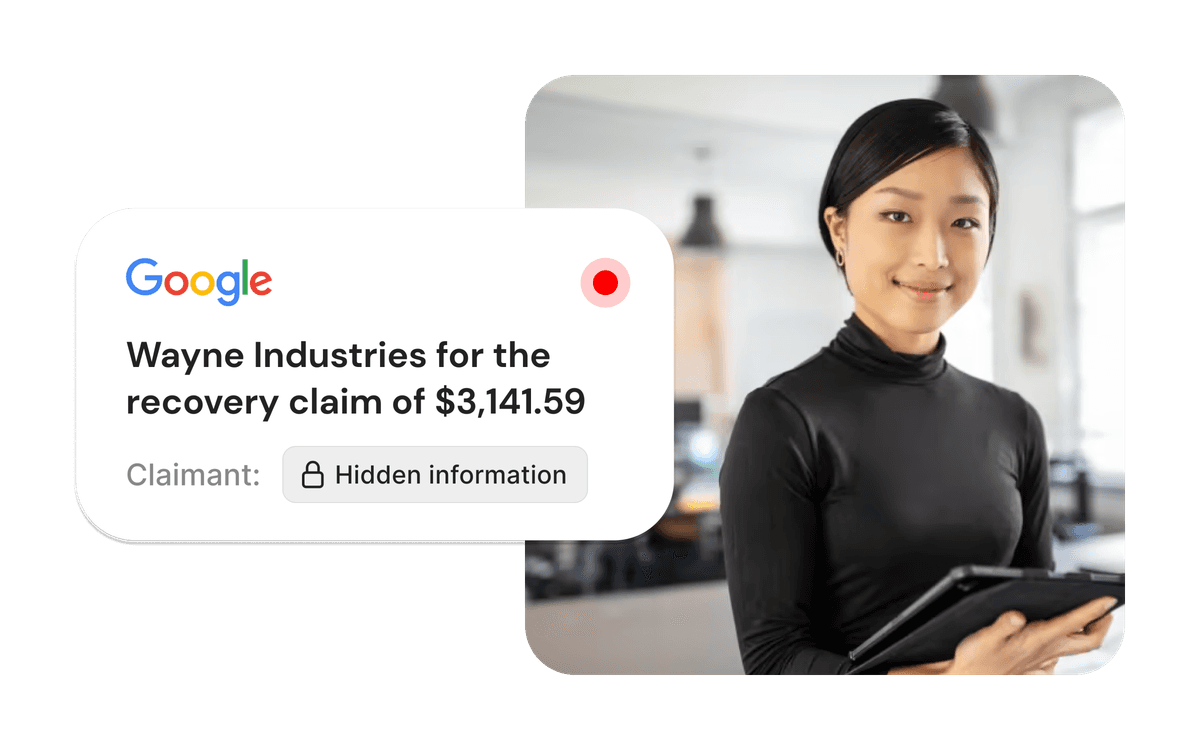

No, Payre is not a debt collector and does not collect or receive money on behalf of any person. Payre serves demand notices and help debtors and creditors manage the case process online. The demand notices sent via Payre hold the same legal weight as those dispatched by debt collection agencies and law firms, enabling creditors (our users) the option to escalate their claim in court with the necessary documentation to prove that attempts at recovery were made.

How long does it take to list my 1st late payment?

You can set up your account and have us send the first e-notice within 5-10 minutes. While sending e-notices is free, many clients opt for our paid service to send a hard copy letter of demand to their debtors.

What are my options on Payre?

Payre provides a free and timeless solution for creditors to list any late payments, as long as the claim is legitimate and can be backed by evidence. On your advice, we may be able to refer your case to our partner lawyers or have the late payment furnished to credit bureau for poor payment practices. At our discretion, we may choose to make an offer to buyover your claim at a fraction of the current outstanding sum.

Does Payre allow listing of personal or business claims?

Your debtor may be an individual (natural person) or a business (legal entity).

Must the creditor be a business?

You as the creditor can either be an individual (natural person) or a business (legal entity).

How different is a lawyer's letter of demand compared to those sent via Payre?

A lawyer will independently review your case, offering legal advice and crafting a strategic plan. They might also increase the claim amount beyond the initial outstanding sum. The work here is comprehensive but expensive and time-consuming.

Do you allow parts of the claim to be changed if certain details were input incorrectly?

Unfortunately you cannot amend a claim once it is submitted. If you noticed that an error was made, please let us know instantly so we are able to notify the intended recipients that the demand notice was sent in error. You'd also have the option to pause the claim indefinitely

Am I able to choose how the outreach cadence message content is delivered?

Fortunately, no. We recognize that each case is unique, which is why our approach to managing your claims has to be tailored accordingly. Our outreach cadence (also known as the dunning process) is fully managed by a team of trained finance and legal professionals. This team is dedicated to optimizing final communication for constructive discussions aimed at achieving settlement before an actual escalation.

Which jurisdictions are currently supported by Payre?

Currently, it is possible to submit a claim in the following countries: United States, United Kingdom, Canada, Singapore, Malaysia, Hong Kong, Australia and New Zealand.

When will the success fee be charged?

We only charge a 10% success fee on every dollar repaid under the Paid plan. To avoid any doubt, debtors are required to make repayments directly to your designated bank account. Once you confirm receipt of the repayment, an invoice will be sent for billing of success fee in the following month. Pursuance will continue indefinitely until a repayment is made.

Can I make a counter claim on my creditor regarding the same matter?

Only create a separate claim against your creditor for unrelated transactions. To dispute a current claim, please respond to it as a debtor with your explanation.